Whew baby! It was an eventful quarter. Lingering inflation, tightening central bank policy, high oil prices and geopolitical tensions were top of mind for investors.

U.S., Canadian and global equities swung back and forth on market volatility, one moment bullishly coping and the next turning bearish, before ending June in doldrums. Equities were dragged down by uncertainty surrounding inflation, rate hikes and the ongoing Russia-Ukraine conflict. In bond markets, U.S. and Canadian yields, which move in the opposite direction to bond prices, continued to rise throughout Q2 on forecasts for slower economic growth, but dipped at the end of June.

But more importantly, there were a number of positive North American economic indicators during the quarter. The unemployment rate in the U.S. and Canada remained low and job vacancies grew. Both U.S. and Canadian retail sales chugged along though Canadian house prices continued to cool.

More evidence the worst of the pandemic is now hopefully behind us was seen in the U.S. temporarily dropping its mask rules for travellers with several major airlines announcing masking was now optional.

The Canadian federal government opted to keep its masking rules but finally started to relax other COVID-19 travel restrictions. It suspended random testing at airports and mandatory vaccination for domestic and outbound international trips.

The Canadian federal government also released its 2022 annual budget which included increased military spending, home affordability measures, green initiatives and a tax hike on large banks and insurers. Ontario, which represents 40% of Canada’s economy, headed to the polls for its provincial election with Premier Ford’s progressive conservatives re-elected for a second term with a second majority. Here in Alberta, which people forget has the world’s third largest oil reserves, recorded its first surplus in seven years following the surge in energy prices since the turn of the year.

Internationally, the G7 congregated in Germany, where the finance ministers agreed to work closely to tame inflation, monitor markets and exchange rates as well as called for faster crypto regulations. (Though that may be shutting the barn door a little late). Pro-EU centrist Macron won a second term as French president, the first French leader to be re-elected in 20 years, which was welcomed by European markets. In the U.K., the Bank of England hiked rates for the fifth time since December 2021, after U.K. inflation rose to 9.1, the highest in the G7. (So far)

Despite some indications mid-quarter that U.S. inflation was moderating, it disappointingly increased again, to 8.6%, with energy, food and housing costs the main contributors. To combat inflation, the Fed implemented two large rate hikes during Q2, 0.50% in May and a jumbo 0.75% in June, its biggest increase since 1994. Fed chair Powell said the Fed is determined to “keep pushing” until inflation comes down. Powell also confirmed the Fed had begun shrinking its asset portfolio of bond holdings. Both of these steps will mean the economy ends up in a stronger position, but will continue to provoke more shrieking from the markets.

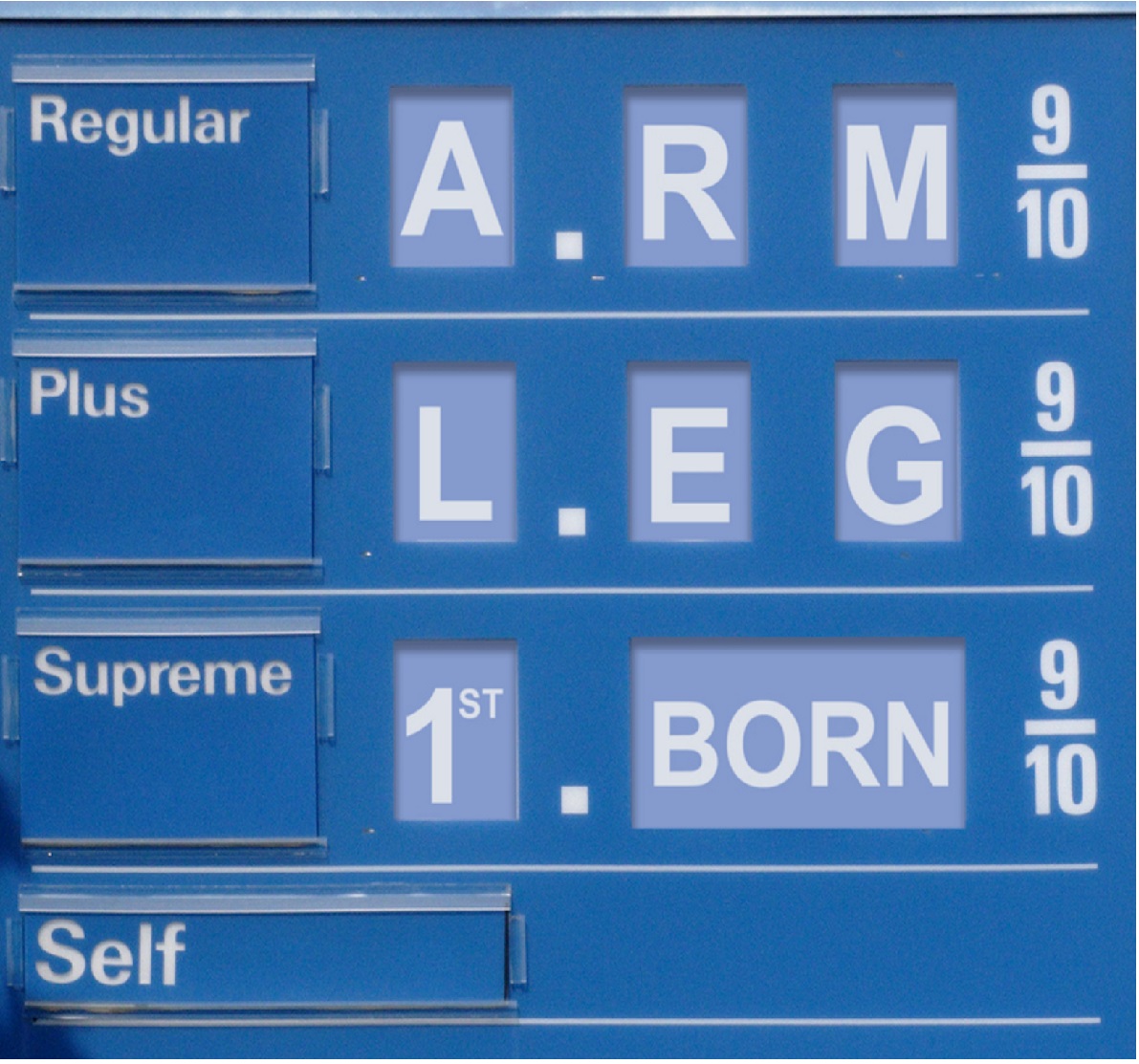

In Canada, inflation kept climbing as well, to 7.7%, the highest since 1983, driven predominantly by food and gasoline prices. According to Statistics Canada, inflation would’ve fallen if gasoline was excluded from calculations. The Bank of Canada raised rates 50 basis points twice during Q2, to 1% in April and 1.5% in June, plus signalled rates will need to rise further to return inflation to its 1-3% target range.

Capital Markets in Q2

It was a brutal three months, absolutely. The S&P/TSX Composite Index ended the quarter down 13.2% while the S&P 500 Index (CAD) posted a loss of 13.4% and the MSCI EAFE Index (CAD) a loss of 11.5%.

Concerns about inflation, high oil prices, tightening central bank policy and the ongoing Russia-Ukraine conflict weighed on U.S., Canadian and global equities during Q2. There was a mid-quarter rebound with the S&P500 Index in particular notching its best results since November 2020, but it wasn’t sustained.

Tech stocks and cryptos pulled U.S. markets down, which spilled over globally. Despite record earnings, Tesla shares slid after Musk’s takeover of Twitter. All the big tech names sold-off after disappointing quarterly results while cryptos fell dramatically as speculative investors exited the sector. The energy-rich TSX Composite Index fared a bit better due to high oil prices. A raft of big Canadian banks and insurers also posted strong earnings and increased dividends. This has created all sort of opportunities for the managers and most are eagerly investing in some of these businesses. (Just like we pay them to do!)

In bond markets, U.S. treasury yields and Canadian yields, continued to rise, before dipping slightly at the end of Q2, possibly indicating the current market pullback captures most of the pain and downside. This may be an indication that the bulk of worries have been priced into bonds, maybe? The yield curve, which is the difference between 10 year and 2 year U.S. treasury yields, remained flat, highlighting tighter Fed rate policy at the short end and forecasts for slower growth at the longer end.

Oil prices continued to be a “thorn in the side” of inflation, topping US$122 a barrel in early June. This was driven by sanctions on Russian imports, signs China’s economy was recovering from the pandemic and U.S. government data showing a drop in its oil stockpiles. Reflecting sky-rocketing oil and waning tech stocks, Saudi oil giant Aramco eclipsed Apple And Microsoft as the world’s most valuable company. How long has it been since that happened?

There was some good news at the tail end of Q2. Following a slip in June, oil posted its first monthly decline since November last year, although it’s still hovering just above US$105 a barrel and up about 43-45% so far in 2022. As result, the loonie, considered a petro dollar, weakened against the greenback.

What we can expect now?

This year has been a bumpy ride as we’ve experienced a market correction with valuations repriced for higher interest rates. While extreme swings are stressful, the worst is likely behind us or at least peaking. A clearer indication will be once we achieve a few months of declining inflation. Economic fundamentals including consumer demand, wage growth, job vacancies and corporate earnings remain healthy. It might take time, but a rebound will occur and history has proven investors are rewarded over the long-term.

The media is screaming about Recession!! Recession!! Sheesh.

Capital Group’s Rob Lovelace has made the case that the current stage looks a lot like ‘Late Stage’ to him. He cites the following:

- Labour Markets Tighten

- Costs Soar

- Profit Margins Contract

- Central bank policy tightens

As signs of a Late stage in the economic cycle. He views this as a positive BUT he also believes a ‘healthy recession’ is needed to flush out the rest of the imbalances in the economy. This will also things to calm and re-set in his view and get everything back on track after over a decade of meddling.

There is no question the markets and the economy need to be brought back to some ‘normalized’ phase where interest rates are reasonable, well-run companies are rewarded with stock appreciation and lower borrowing costs than poorly run companies AND we see the markets being allowed to be ‘choppy’ and not have volatility constantly papered over by the central banks. Overall, this trims excess returns and grows the economy in a natural, healthy way.

Of course, regardless of where we are in the market and economic cycle, it’s important to take a disciplined approach to investing and stay focused on your long-term goals. This strategy helps you keep your emotions out of investing, typically buying high and selling low like many investors do. Ongoing monitoring and reviewing of your portfolio also ensures it remains on track. Diversifying investments reduces risk as well.

The information in this letter is derived from various sources, including CI Global Asset Management, Statistics Canada, Bank of Canada, US Treasury Dept, Bloomberg, Reuters, National Post, Investment Executive, Advisor.ca, Wall Street Journal, Daily Mail, Toronto Sun, TNC News, The Post Millennial, MSN.com, CNN, Coindesk.com and The Guardian as at various dates. This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources and reasonable steps have been taken to ensure their accuracy. Market conditions may change which may impact the information contained in this document. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances.